WaiterOne offers a flexible and intuitive way to manage taxes, making it easier for businesses to handle varying tax rates depending on the type of sale. A frequent question we receive is how to set up different tax levels for dine-in versus takeaway orders. Let’s break it down step by step.

Three Tax Levels Per Group/Table

In WaiterOne, you have the ability to assign up to three tax levels per group or table. This allows you to create different tax settings based on the nature of the sale. For example, you might have one tax rate for dine-in customers and a different one for takeaway orders. Here’s how you can set it up:

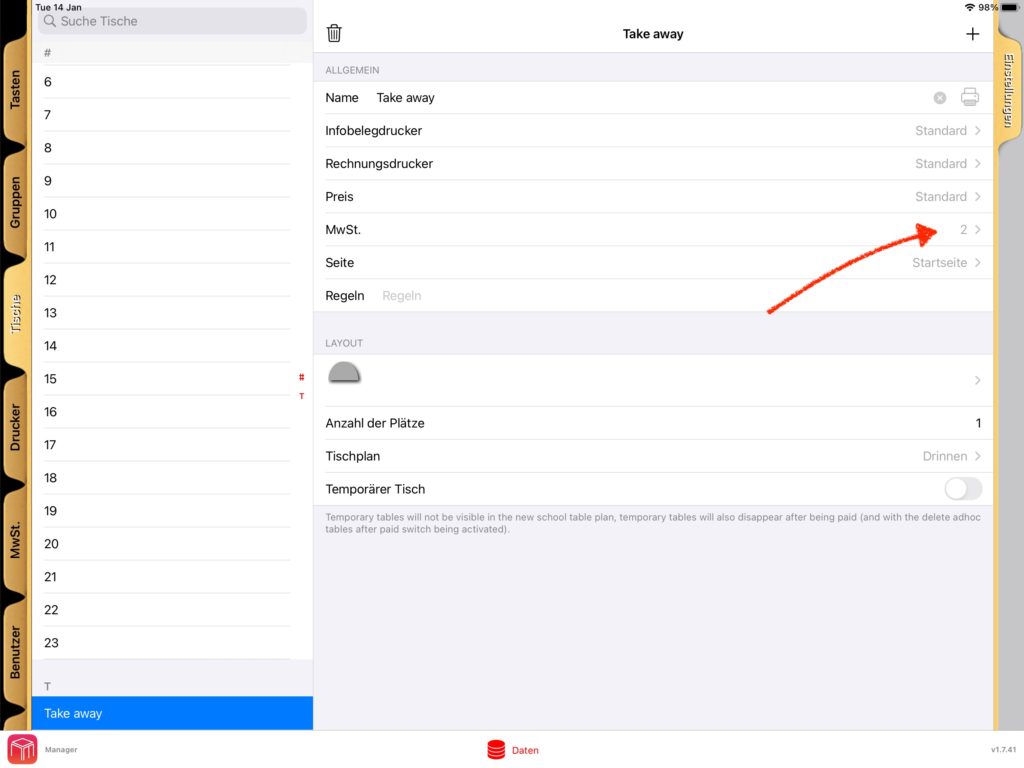

Step 1: Configure a Table for Takeaway

To differentiate tax rates for takeaway orders, start by creating a table specifically for takeaway sales. Once this table is set up:

- Assign Tax Level 2 as the tax level for this takeaway table.

- When you process a sale using this table, the system will automatically apply the tax rate assigned to Tax Level 2.

This setup ensures that any sales recorded under the takeaway table will be taxed at the appropriate rate.

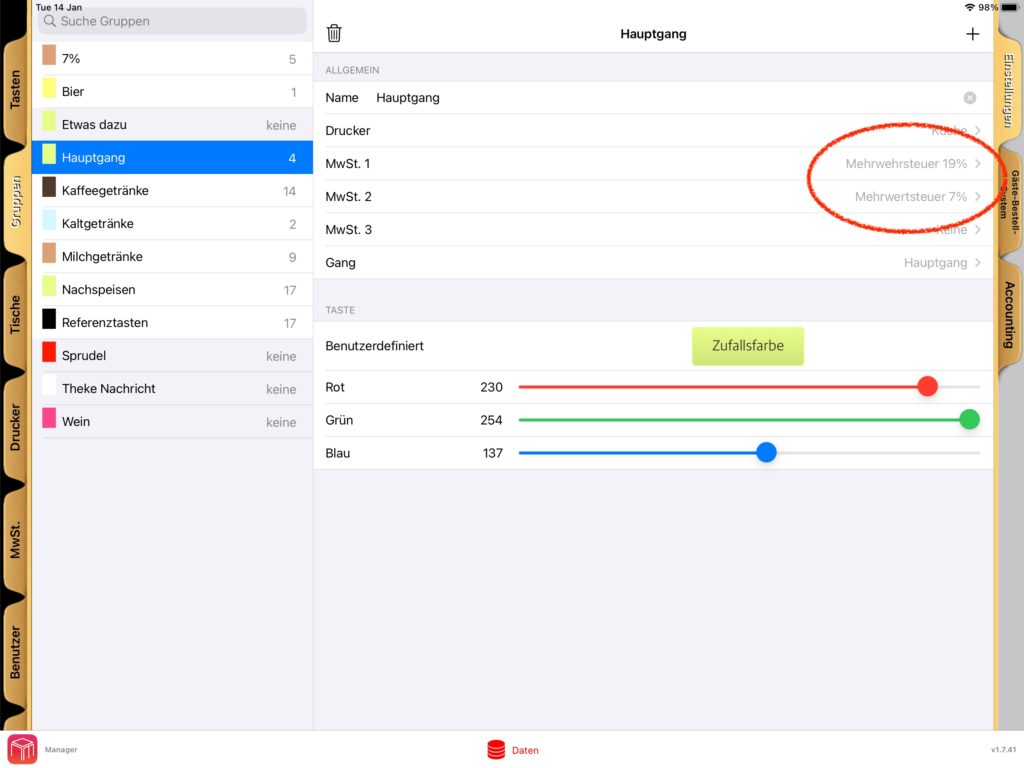

Step 2: Adjusting Tax Levels for Other Tables

If you’d prefer to reverse the setup, you can:

- Use Tax Level 1 for takeaway orders.

- Assign Tax Level 2 for all dine-in tables.

This flexibility allows you to tailor the tax configuration to your specific business needs, ensuring accurate taxation for every scenario.

Where to Configure These Settings

WaiterOne’s interface provides an easy way to configure tax levels. Here are the steps:

- Go to the Data menu in WaiterOne.

- Navigate to the Groups/Tables section.

- Select the desired table or group and assign the appropriate tax level.

- Save your changes.

Visual Guides for Configuration

To make the process even simpler, we’ve included screenshots that illustrate how to configure these settings. These guides will help you navigate through the interface and ensure you’re setting everything up correctly.

Why This Matters

Managing taxes effectively is not just about compliance; it’s also about maintaining clarity in your sales reports. By leveraging WaiterOne’s tax level settings, you can:

- Ensure accurate billing for customers.

- Simplify your accounting processes.

- Avoid potential errors that could lead to discrepancies.

Conclusion

WaiterOne’s ability to handle multiple tax levels per group or table is a powerful feature for any business that deals with both dine-in and takeaway orders. With the right setup, you can ensure smooth operations and accurate tax management.

Have questions or need assistance? Feel free to reach out. We’re here to help you make the most of WaiterOne.

Happy configuring!